SEB banko prezidento patarėjas Gitanas Nausėda „Žinių radijo“ laidoje „Atviras pokalbis“

teigė, kad šalies politikų neapsisprendimas dėl euro įvedimo gali brangiai kainuoti.

„Mes įsivaizduojame, kad euro įvedimas yra, jeigu kalbant krepšinio terminais, kažkoks trijų metrų skersmens krepšinio lankas, į kurį kamuolį gali įmesti bet kada. Šiandien nenoriu, įmesiu rytoj... Bet juk taip nėra. Mes šiuo metu turime tikrai labai neblogas sąlygas patekti į euro zoną tiek dėl infliacijos, tiek dėl valstybės skolos, tiek dėl net biudžeto deficito, o rytoj nėra jokių garantijų, kad pasaulyje infliacija neišaugs, Europoje infliacija neišaugs, Lietuvoje infliacija neišaugs... Ji gali išaugti ir mums gali būti labai sunku į tą korsetą įsisprausti 2015 ar 2016 m.“, – perspėjo G.Nausėda.

Perfrazuodamas Gitaną Nausėdą vairavimo terminais, verčiau siūlau eurą įsivaizduoti kaip trijų metrų gylio duobę, kurią kelyje reikia atsargiai apvažiuoti. Nebent trokštume ateities, kurioje vietoje demokratijos būtume "krizės svertais" vairuojami puse lūpų kalbančių ECB statytinių.

Kalbėdamas apie eurozonos bėdas, britų laikraščio Daily Telegraph apžvalgininkas

Ambrose Evans-Pritchard paminėjo šiemet italų kalba išleistą knygą "

Morire di Austerita". Knygos autorius Lorenzo Bini-Smaghi iki 2011-ųjų lapkričio buvo aukščiausio lygio ECB funkcionieriumi - priklausė ECB vykdomosios tarybos šešetui.

Citata nuo knygos viršelio: "La crisi è soprattutto politica. Riflette l’incapacità delle democrazie occidentali di risolvere problemi accumulati da oltre un ventennio. Chi è eletto democraticamente fa fatica a prendere decisioni impopolari che possono comprometterne la rielezione. L’emergenza diventa così il motore dell’azione politica e il modo per giustificare le manovre correttive di fronte agli elettori, con la conseguenza che la cura - tardiva e varata sotto la pressione dei mercati - diventa ancor più dolorosa e impopolare."

Vertimas (ačiū už pagalbą +Agne Ma): Krizė yra visų pirma politinė. Ji demonstruoja vakarietiškų demokratijų nesugebėjimą spręsti daugiau nei dvidešimt metų besikaupiančias problemas. Demokratiškai išrinktos vyriausybės nesugeba daryti nepopuliarių sprendimų, kurie galėtų neigiamai įtakoti perrinkimą. Todėl krizė tampa politiniu stimulu ir būdu pasiteisinti prieš rinkėjus dėl korekcinių manevrų, duodančių reikiamą rezultatą. Bet pavėluotai, rinkų spaudimo fone vykdomos priemonės būna dar skausmingesnės ir nepopuliarios.

Knyga pateikia problemų, kurių tos "neefektyvios" demokratijos nesugeba "išspręsti", paaiškinimą: Target2 (centrinių bankų tarpusavio garantijų sistemos)

disbalansai. Kitaip - pati eurosistemos esmė. Pasirodo, buvusio ECB vykdomosios tarybos nario nuomone, tai "demokratijos problema" ir ją leidžiama spręsti, "spaudžiant krizės svertus".

Kapitalas (bankų įsipareigojimai eurais) eurozonoje, žinote, turi "mobilumo teisę". O patys bankai gali įsipareigoti, kaip tik jiems šauna į galvą. Pavyzdžiui banką valdantys asmenys per statytinius gali įsipareigoti patys sau. Jei nori, gali tą įsipareigojimą perkelti į bet kurį kitą eurozonos banką (pervesti pinigus). Pervedimui įvykus, valstybės balansas Target2 sistemoje pablogėja visa to pervedimo suma. O valstybės, į kurią pinigai "nuėjo", "pagerėja".

(Jeigu toks bankas nusprogtų, ir paaiškėtų, kad pusė jo aktyvų fiktyvūs, anuliuoti tokios operacijos, nepasibylinėjus kelių valstybių teismuose, nebūtų įmanoma.)

Centrinio banko funkcionieriaus politikos supratimas toks: įsiskolinimai, atsirandantys per Target2 tvarkant neaišku kokius reikalus bankams su neaišku kokiais balansais [dar vienas "balansų skylės" paaiškinimas

čia], turi būti "aptarnaujami" realaus ekonominio produkto, realios vertės srautais. Politikai privalo tai iš savo ekonomikų išspausti.

Ir apie tai neturi būti viešai kalbama kitaip, kaip apie fiskalinę drausmę. Rekomenduojama reklamuoti būsimą "

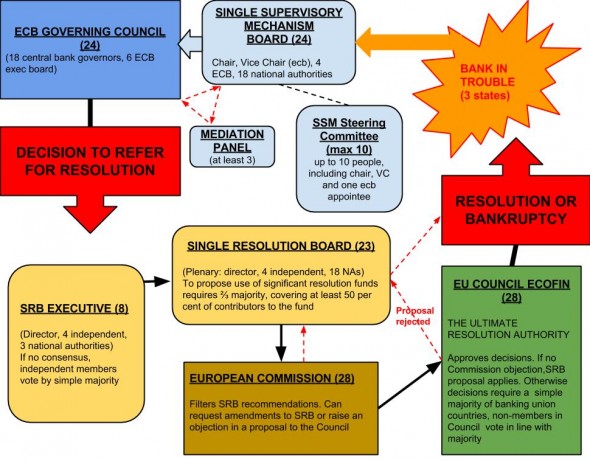

bankų sąjungą", būsimą bankų priežiūros mechanizmą, būsimą garantinį fondą į kurį per dešimt metų gal bus surinkta 50 milijardų eurų.

Kam nepatinka - pats kaltas. Knygoje atskleidžiami ECB Italijoje inicijuoto politinio perversmo, įvykdyto Berlusconi 2011-aisiais pradėjus konsultacijas dėl Italijos išstojimo iš eurozonos, faktai.

Visų eurozonos šalių Target2 įsipareigojimai Vokietijai - virš pusės trilijono eurų,

bankų sistemos balansų skylė - dar ne mažiau trilijono. Knygoje aprašomas epizodas, kaip 2012-aisiais Vokietijos kanclerė Merkel jau buvo susiruošusi išmesti Graikiją iš eurozonos, bet išgirdus paaiškinimą, kokios bus grandininės bankrotų reakcijos, ir kas galiausiai turės mokėti, persigalvojo. Rizika ir įtampos susidarė tokios, kad Target2 prižiūrėtojai Vokietijoje "naktimis nebemiega".

Kadangi tie įsipareigojimai kolektyviniai [dar vienas paaiškinimas

čia], Vokietijai palanku, kai juos prisiima daugiau šalių. Kaip ne keista, tai palanku ir naujai prisijungiančiųjų narių elitams.

Propagandos mašinos įjungtos. Bankininkai juodais kostiumais Lietuvoje:

V. Vasiliauskas: neturime teisės dar kartą paleisti vėjais galimybės įsivesti eurą;

G. Nausėda: euro [neįvedimo] klausimas Lietuvai gali brangiai kainuoti;

bet...

Vasiliauskas: krizė atskleidė finansų sistemos spragas

Gal manote, kad ponas Vasiliauskas kalba apie sistemines spragas? Besąlygines garantijas, tik po dešimties metų sugalvojant, kad tų garantijų galutiniai naudotojai - bankai - turėtų būti išties, o ne formaliai kontroliuojami?

Žinoma, ne. Spręskite patys:

Pono Vasiliausko teigimu, Europai būtinas toks finansų priežiūros ir reguliavimo priemonių rinkinys, kuris ne tik sustiprintų finansų sistemą, bet ir paskatintų ekonomikos, ypač smulkiojo ir vidutinio verslo, finansavimą.

„Vienas didžiausių ES iššūkių – užtrukęs finansų sistemos susiskaidymas, neigiamai veikiantis ūkio raidą. Tik pašalinę jo priežastis, galėsime atkurti normalų finansų rinkos funkcionavimą ir taip paskatinti ekonomikos atsigavimą. Mūsų įsitikinimu, tai vienas iš svarbiausių Lietuvos pirmininkavimo tikslų, todėl šiandien ir rytoj vykstančiame susitikime išskirtinį dėmesį skirsime bankų sąjungos bei mažųjų ir vidutinių įmonių finansavimo klausimams“, – pranešime cituojamas Lietuvos banko valdybos pirmininkas.

Ambrose Evans-Pritchard žodžiais:

He [Lorenzo Bini-Smaghi - ed.] confirms that Germany is indeed on the hook for €574bn of credits from the Bundesbank to the central banks of Greece, Portugal, Ireland, Italy, Cyprus, and Slovenia.

We have always been assured that the so-called Target2 credits within the ECB's internal payments system is a technical adjustment, without significant risk.

Mr Bini-Smaghi states that any EMU state leaving the euro would face likely default on external obligations. "The national central bank would not be able to repay liabilities accumulated in relation to other members of the euro system, which are registered in the internal payments system of the Union (known as Target2). The insolvency would provoke substantial losses for counter-parties in other eurozone countries, including central banks and states." [...]

This means that if the euro blows up, the Bundesbank still owes this money to the same private banks, which could be Deutsche Bank, but could also be Nomura, Citigroup, or Barclays. This is not fictitious. The Bundesbank cannot default on these securities.

Perhaps I am a bear of very little brain, but I have yet to hear a satisfactory explanation as to how this can be conjured away painlessly, as we are told by a long list of illustrious economists that it can be. I have never seen them answer this issue. They publish long papers, blinding everybody with science as economists are prone to do (usually bluffing), but never get to the core point.

The fact is that Target2 is the flipside of intra-EMU capital flight. Private investors have pulled out of Club Med, dumping their claims onto the taxpayers of Germany and the northern creditor states. Dress this up any way you want, but that is the reality.

Yes, the Bundesbank could print money with gay abandon in such a crisis – and would have to do so to avoid a deflationary shock, and on a much larger scale than anything suggested so far within the EMU construct. Germany would no doubt muddle through, but its monetary doctrines would be shredded.

The Bundesbank's official position is that the Target2 controversy is a storm in a teacup. In fact, they don't believe it themselves. A Bundesbanker with direct responsibility for Target2 said in my presence that he "worries about it every night". The bank's own president Jens Weidmann testified last year that the imbalances are an "unacceptable risk".

I suspect that somebody is trying to pull the wool over the eyes of the German people, and it is not the splendidly outspoken Jens Weidmann.

---

Brad DeLong:

No mystery, guys; you messed up.